23+ Ltv mortgage calculator

You only have to enter two. Ad Top Home Loans.

Cash Conversion Cycle Calculator Plan Projections Calculator Words Conversation Cash

Loan-to-value LTV is the ratio of mortgage to property value expressed as a percentage.

. Top-Rated Mortgages for 2022. A Loan-to-Value ratio for a property is equal to all mortgages on a property divided by the appraisal value of the property. To find out your LTV simply divide 200000 by 250000 and then multiply by 100.

The Loan to Value Ratio LTV shows how much equity you have in a house relative to the amount you want to borrow or already have borrowed and is one of the key risk factors. The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages. Its a percentage figure that reflects the proportion of your property that is mortgaged and the amount that is yours.

This gives you an LTV of 80 so you should look for mortgage deals that are available up to 80 LTV. Typically a loan-to-value ratio should be 80 or less to avoid having to add PMI. You can use this Loan to Value Calculator to calculate the loan-to-value LTV and cumulative loan-to-value CLTV ratios for your property.

You currently have a loan balance of 140000 you can find your loan balance on your monthly loan statement or. Besides using an LTV calculator you can also use the formula to calculate LTV. Loan-to-Value LTV is a ratio between the amount of a loan over the value of what you are purchasing.

For assistance in other languages please speak to a representative directly. LTV Mortgage amount Property value 100. More specifically LTV is used for mortgages where it represents the ratio between.

Ad Want to Know How Much House You Can Afford. Current combined loan balance Current appraised value CLTV. The Consumer Financial Protection.

To calculate your LTV. See Up to 5 Free Loan Quotes in Minutes. Calculate Your Mortgage Savings.

For instance lets assume you own a home that costs 300000 and your current mortgage balance was 240000. Phone assistance in Spanish at 844-4TRUIST 844-487-8478 option 9. For example if you have a mortgage of 150000 on a house thats worth 200000 you have a loan-to-value of 75 therefore you have 50000 as equity.

For example if youre buying a 100000 property with a 10000 10 deposit youll need a 90. The formula for LTV is. Loan to Value LTV Calculator.

LTV mortgage balance home value x 100. This online calculator is ideal for use with both home mortgage purchase and home mortgage refinance plans. Get A Loan Estimate From Top Lenders Today.

The algorithm behind this LTV calculator applies the fomula explained here. For example if you have a mortgage of 150000 on. Use our Loan-to-Value LTV calculator to work out what loan-to-value your mortgage will need to be.

Check out the webs best free mortgage calculator to save money on your home loan today. Ad Use Our Online Refinance Calculator to Calculate Your Low Mortgage Rate. To see how the loan-to-value LTV formula works heres the basic formula and an example.

Although this formula for. If you own a home worth 1000000 and get a new first. LTV Mortgage Amount Appraised property value.

Whether youre wondering if you have enough equity to qualify for the best rates or youre concerned that youre too far upside-down to refinance under the Home. There are options to include extra payments or annual. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current.

Loan-to-value becomes a key. Rates are At a 40-year Low. Ad Our Calculators And Resources Can Help You Make The Right Decision.

Loan to Value LTV is used to express how much of the property value will be mortgaged. In terms of risk assessment a high loan to value ratio indicates. Ad Use Our Online Refinance Calculator to Calculate Your Low Mortgage Rate.

Ad Compare The Best Mortgage Rates. Estimate The Home Price You Can Afford Using Income And Other Information. Calculate Your Home Loan.

Our Loan to Value LTV Calculator is easy to use.

Mortgage Insurance When Is It Required Mortgage Protection Insurance Refinance Mortgage Private Mortgage Insurance

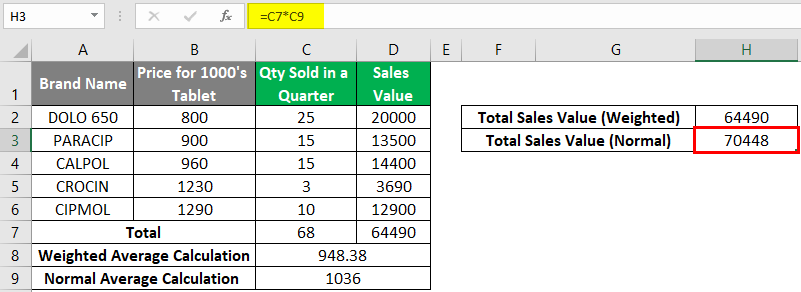

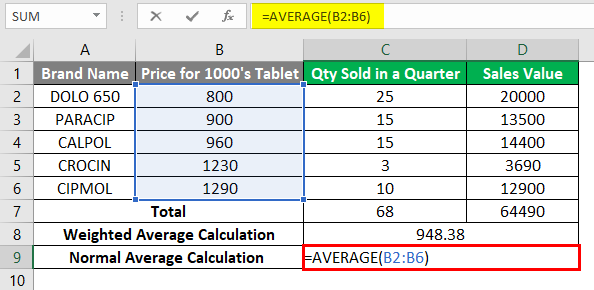

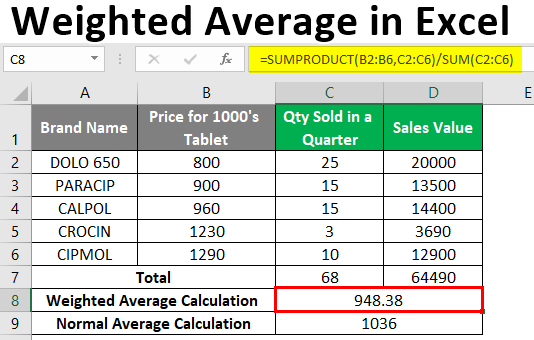

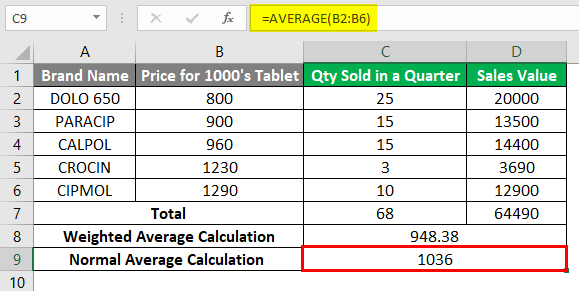

Weighted Average In Excel How To Calculate Weighted Average In Excel

Open Access Loans For Bad Credit Dating Bad Credit

What Is The Difference Between The Kentucky Freddie Mac Home Possible And The Fannie Mae Home Ready Loan Program Fannie Mae Kentucky Home Loans

2

Cityscape A Journal Of Policy Development And Research National Survey Of Mortgage Originations

Loan Product Menu Flyer Usda Loan Marketing Flyers Menu Flyer

Reverse Mortgage Age Chart What Percentage Of Appraised Value Will I Get Reverse Mortgage Info Reverse Mortgage Refinance Mortgage Mortgage Loans

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers Zero Down 100 Financing Mortgage Loans Home Loans Mortgage

Student Profile Book Career Advancement Services Indian

Mortgage Payoff Watches Refinancing Mortgage Mortgage Payoff Mortgage Interest Rates

2

We Ve Dropped Our Minimum Fico Score To 620 For Kentucky Mortgage Loan Approvals Mortgage Loans Va Mortgage Loans Mortgage Lenders

Weighted Average In Excel How To Calculate Weighted Average In Excel

Working Capital Needs Calculator Plan Projections Business Planning Business Planner How To Plan

Weighted Average In Excel How To Calculate Weighted Average In Excel

Weighted Average In Excel How To Calculate Weighted Average In Excel